EN

Verification protects your account

Verification protects your account

Spot trading is an easy way to invest and trade. When investing in cryptocurrency, it is usually with spot transactions on the spot market, such as buying BTC at market price.

WHAT IS THE SPOT MARKET?

This is an open financial market, where the processes of buying and selling assets take place in a short time.

The buyer purchases from the seller an asset for fiat currency or an asset negotiated by the parties. Typically, delivery from seller to buyer is instantaneous, but it is often driven by the type of trading asset bought and sold.

Spot markets are also called cash markets, with payments made in advance.

There are several forms of spot markets and they are traded through third-party exchanges. However, it is possible to trade directly, without the intervention of exchanges, through over-the-counter transactions.

WHAT IS SPOT TRADING?

Spot traders make a profit by acquiring assets in anticipation of rising asset prices.

When this happens, and the price rises to the optimal for the trader, they resell it with the greatest profit for themselves.

Cellular traders often use the so-called shorting, that is, the sale of assets and their re-purchase in the event of a price decline.

HOW TO START SPOT TRADING AT AWEX?

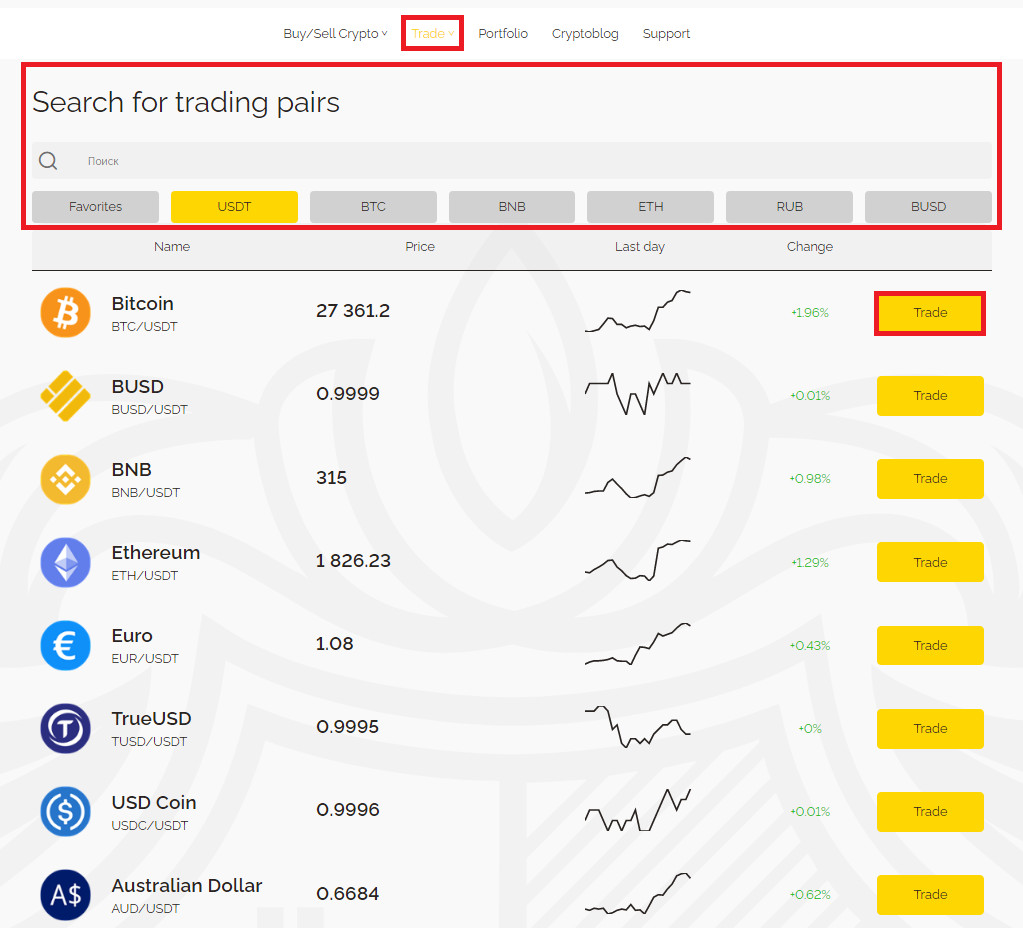

Spot trading at AWEX is quite simple. You need to have a registered and verified account on our AWEX platform. Consider the interface of AWEX and learn how to make a spot transaction. For the transition to trading platform, open the main page of AWEX, move the cursor to the section «Exchange», select the asset you want to trade and click «Trade».

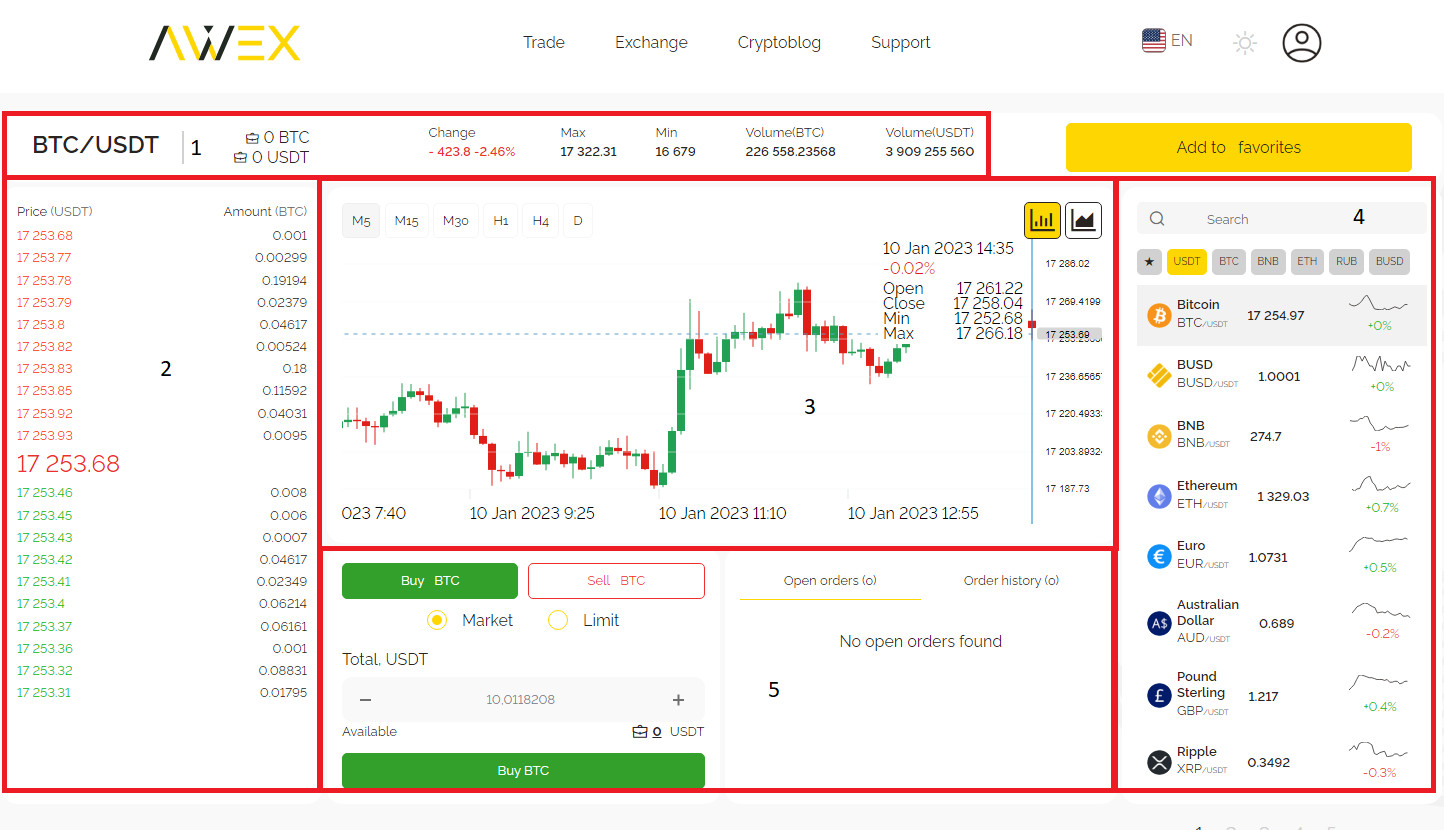

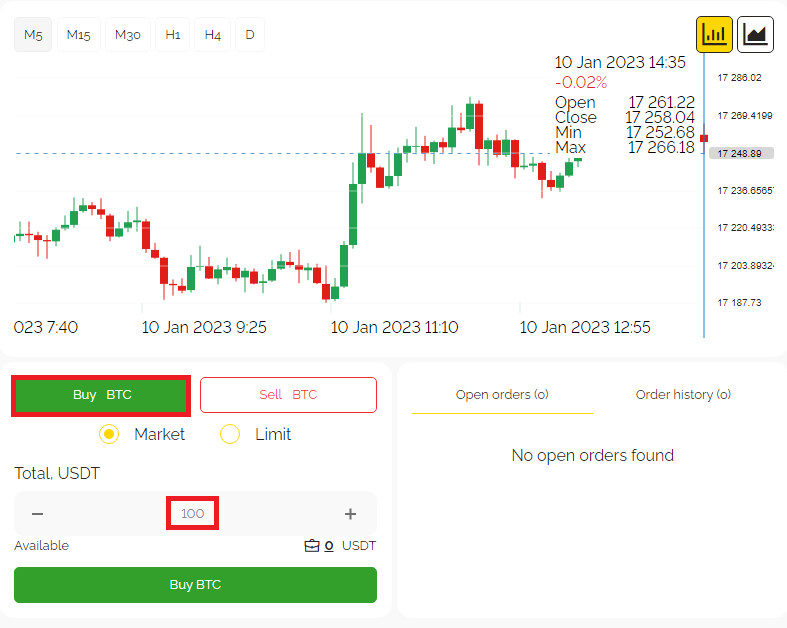

Next you will see a trade interface with several partitions.

Lets look at the simplest spot deal you can make: a market order. Suppose you want to buy Bitcoin (BTC) in the amount of $5000 (USDT). To do this, you need to enter 5000 in the field «USDT Sum» and click «Buy BTC».

Advantages and disadvantages of spot markets

Every trade and strategy you face has its own advantages and disadvantages. Understanding this will help you reduce risks and trade more confidently. Spot trading is one of the easiest, but it also has strengths and weaknesses.

Advantages of spot markets

SPOT MARKET IMPERFECTIONS

Depending on what you trade, spot markets may leave you with assets that are uncomfortable to hold.

The need for stability for some assets, individuals and companies.

The potential profit from spot trading is much smaller than from futures and margin.

DESIRED PRICE ±20%, USDT

"I want to buy or sell an asset more expensive or cheaper than the market, but I cannot deviate from the current price by more than 20%"

ADVANTAGES AND DISADVANTAGES OF SPOT MARKETS

Every type of trading and strategy you encounter has its advantages and disadvantages. Understanding this will help you reduce risks and trade more confidently. Spot trading is one of the simplest, but it also has strengths and weaknesses.

Advantages of spot markets

Conclusion

Trading on spot markets is one of the most common ways of trading, especially for novice traders. Although spot market trading may seem simple, it never hurts to know its advantages, disadvantages and potential strategies.

{{ newIndex + 1 }}

/{{ gallery.length }}