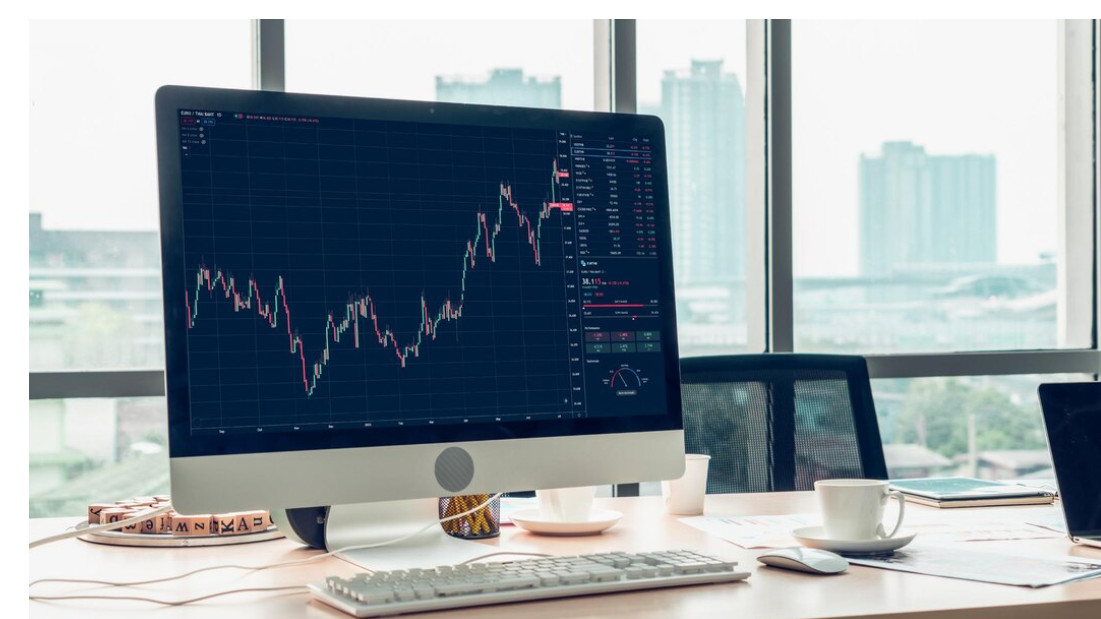

Traditional trading is based on the capital you have on your account. But the exchange has the ability to increase the deposit using leverage. However, in this case, there is a risk of loss of all assets in the account.

To start trading using credit facilities you need to provide a percentage of the total cost of the loan (margin). Leverage is the ratio of credit to margin. If you make a $100,000 deal with a $10:1 leverage, you will need only $10,000 in cash, the rest will be provided by the exchange.

Advantages of margin trading:

- the possibility of obtaining a larger profit by increasing the value of your position;

- Ability to quickly divide positions, having a small deposit.

Disadvantages of margin trading:

- risk of increasing losses at the slightest volatility;

- the possibility of losing the entire deposit.

When margin trading in the cryptocurrency market should be especially careful, because the volatility in the market is high, and the shoulders reach 100 to 1.

For those who do not want to take such risks, there is another leverage service - margin financing. This is an opportunity to lend your funds to other users for shoulder transactions.

Margin trading is a convenient tool in the hands of an experienced trader, allowing to increase profits, but with the wrong use of «margin» can ruin anyone. Its up to you to use it or not.

Verification protects your account

Verification protects your account