Benefits of cryptocurrency

Digital assets offer companies a number of advantages over traditional finance, such as decentralization, security and transparency. This is leading to a growing interest in cryptocurrency from both private investors and large investment funds.

The very value of cryptocurrency lies not in the value of coins or the interest income from ownership, but in the technology behind certain projects. Let's compare the capabilities of established companies and their digital competitors:

- Visa processes an average of about 1,700 transactions per second, but claims to support processing 24,000 transactions per second. Mastercard processes about 5,000 transactions per second. Solana's hybrid protocol supports 50,000 TPS (transactions per second).

- The transfer fee for the Ripple token for each transaction is $0.0003. For PayPal transfers, the fee is about 3.4%, which is ten times higher.

- Blockchain allows to guarantee the security of transactions, data storage, proof of ownership of the object.

Decentralization

One of the advantages of cryptocurrency is its decentralization. This means that it is not controlled by a central bank or government. This makes it more resistant to inflation and political turmoil.

Cryptocurrency is also more transparent than traditional currencies. All cryptocurrency transactions are recorded on the blockchain, which is a public ledger. This allows you to track the movement of funds and prevent fraud.

International transfers

Cryptocurrency can be used for cheaper and faster international transfers. It can also be used to create new business models such as decentralized finance (DeFi).

DeFi is a set of financial services that run on a blockchain with no intermediaries involved. This can make financial services more accessible and available to everyone.

Examples of cryptocurrency use in finance

Here are specific examples of how cryptocurrency is already impacting the economy and finance:

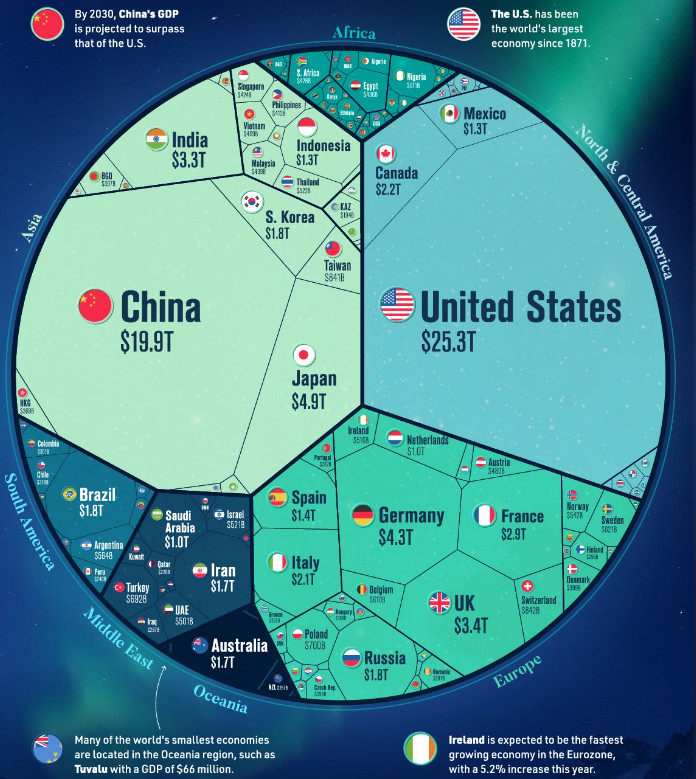

- Cryptocurrency is being used for cheaper and faster international transfers. For example, transferring funds from the U.S. to China using bitcoin can take just a few minutes and cost less than $1.

- Cryptocurrency is being used to create new business models such as decentralized finance (DeFi). DeFi is a set of financial services that run on a blockchain with no intermediaries involved. This can make financial services more accessible and available to everyone.

- Cryptocurrency is used for investment and speculation. Many people buy cryptocurrency in hopes that it will increase in value. Others use cryptocurrency to trade on exchanges.

- With the concept of Initial Coin Offering (ICO), startups can raise investment directly from potential users and investors. This allows new companies to quickly obtain the necessary funds without intermediaries and complex procedures, attracting innovative ideas and accelerating economic development.

- In developing countries, where the majority of the population does not have bank accounts, cryptocurrency can be a powerful tool to increase financial inclusion. It allows funds to be transferred between countries without intermediaries and provides a secure and affordable system for storing and transferring value.

- Smart contracts, decentralized applications (DApps) and distributed data storage are all technologies that can have a positive impact on the development of the economy. Cryptocurrency startups and blockchain developers are working on new solutions that can improve the productivity, efficiency and security of various industries.

- Traditional financial transactions, especially internationally, are often costly and time-consuming. Cryptocurrency enables instant and low-cost transactions without the need for intermediaries. This reduces fees, increases liquidity and facilitates faster business growth.

Conclusion

Cryptocurrency has already begun to transform the economy and finance, and this is just the beginning. It provides new financing opportunities, promotes financial inclusion, drives innovation and improves the efficiency of financial transactions. Contrary to critics, cryptocurrency continues to gain momentum and its impact on the global economy and financial system remains undeniable.

Cryptocurrency is still in its developmental stage, but it has the potential to have a significant impact on the economy and finance. It can make financial systems more efficient, transparent and accessible. It can also help create new business models and stimulate economic growth.

Verification protects your account

Verification protects your account