Buying dollars

Historically, the most popular way to save money has been to buy currency.

Before 2020, this method had no downside, as inflation in the U.S. was only 2% per year. But now, because of the huge issuance, inflation has risen dramatically. To this is added the risk of limiting the circulation of foreign currency in the country. So those who want to keep their money in dollars will have to put up with inflation and opt for cash form of currency.

Buying real estate

Another popular way of investing money is buying real estate.

In the countries of the former Soviet Union, people used to believe that having their own apartment is a sign of success and stability. People buy housing not only for themselves, but also for their children and grandchildren. Such real estate can be rented out. Buying or building real estate is a profitable investment, but only if a number of conditions are met.

- The property is bought at the construction stage in a popular neighborhood!

- Inexpensive and reliable repairs are made

- Housing has low utility bills due to an autonomous boiler and the absence of losses on UDI.

- The property is leased (better in commercial) and there is strict control over the behavior of tenants.

- The property is insured and subject to periodic repairs.

If these requirements are met, buying a home is a good way to save and make a little money. But don't forget that there are risks of damage to the property, lower demand, lower prices and higher taxes and fees. The yield from renting after subtracting expenses will be at the level of a bank deposit without taking into account the growth in the value of the object itself (if this growth will be).

Investing in the stock market

The next investment option that has been gaining popularity in recent years is entering the stock market and buying stocks, bonds and units of investment funds. This type of investment allows you to save money at understandable risks.

For example, buying federal loan bonds (OFZ), as well as a number of corporate bonds will allow you to save money from inflation. Risks are minimal. For qualified investors, bonds of other countries are available for purchase, where risks may be lower, but the coupon level will be lower. Buying shares will allow you to capitalize on the growth of the value rate or on the payment of dividends from the company.

Buying shares is a risky way of investment, as you can lose almost the entire amount in case of bankruptcy of the company. Also, do not forget about geopolitical risks, in which you can lose access to your assets.

The way out of such a situation is to form a diversified portfolio of stocks, bonds, funds and metals, which will need to be periodically balanced. In this case, for 5 - 10 years, you can save money from inflation and even earn a little.

However, at the moment, the status of qualified investor is not available to everyone, hence the range of investment is greatly narrowed.

Buying cryptocurrency

The latest and least known way of investing money that became popular in 2023. After sanctions were imposed on the purchase of foreign securities and real estate, buying cryptocurrency became the only free way to invest in the global economy.

Although cryptocurrency is a volatile and unpredictable asset, the current economic situation has made digital money an "island of stability" and built a road of life for blocked companies and countries to the global economy.

Citizens, companies and entire nations are using popular stablecoins to save, transfer and invest. Financial regulators, such as the SEC in the US, cannot get XRP banned, and the ETH currency has long been a platform for hundreds of global financial vehicles.

The global economy, without realizing it itself, has embraced blockchain technology and thus legalized the cryptocurrency market. Buying cryptocurrency now, is easier than any of the assets in this article (except the dollar).

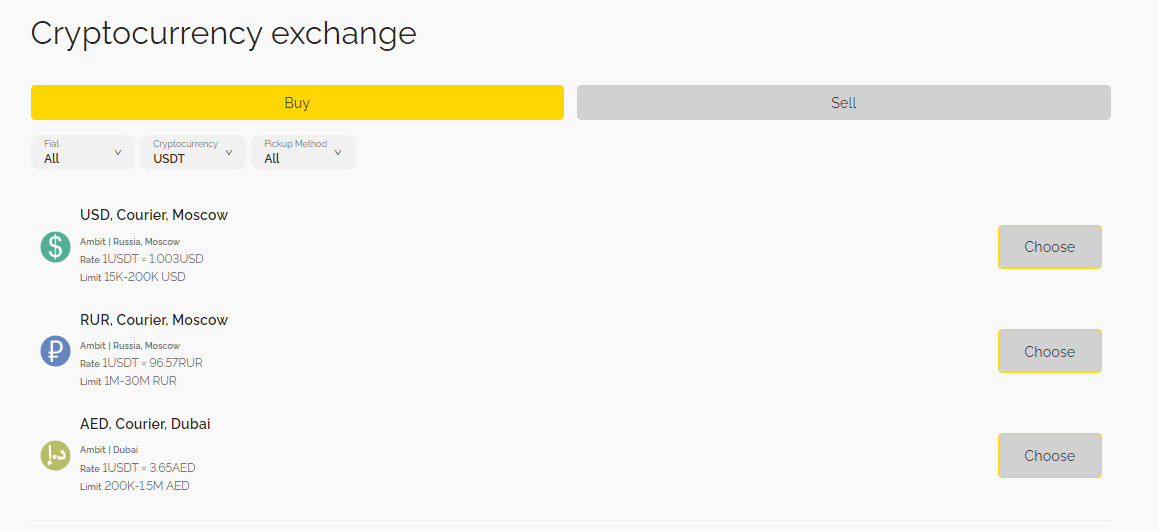

It is enough to choose USDT and click the Buy button. And then select a convenient way to enter rubles on the exchange service.

Conclusion

Each of the described areas of investment has its own advantages and disadvantages. In different situations in the economy, some assets grow and other assets fall. Our task is not to chase the ideas promoted in the media, but to create a diversified portfolio in which you will have both conventional currency and digital assets. You should not forget about your health, education, family, and life.

Being financially literate and forward-thinking is the result of constant learning and self-improvement. Remember that there are no one-size-fits-all solutions, but choosing the best investment option for yourself and keeping an eye on the growing sectors of the economy will help you keep your savings for years to come.

Verification protects your account

Verification protects your account